Why a Diversified Portfolio is Safer Than Keeping All Eggs in One Basket

Investing is all about managing risk while maximizing returns. One of the fundamental principles in investment strategy is diversification—the idea that spreading your money across different assets reduces risk. As the old saying goes, “Don’t put all your eggs in one basket.” But why exactly does diversification make sense, and how should you structure your portfolio for safety and growth?

The Risk of Concentrated Investments

If you invest all your money into a single stock or asset class, you are exposed to high levels of risk. If that investment underperforms or the company faces financial difficulties, your entire portfolio suffers. Even historically stable companies can experience unexpected downturns due to economic shifts, regulatory changes, or management issues. Diversification helps protect against such scenarios by ensuring that a loss in one area doesn’t wipe out your entire investment.

The Power of Diversification

A well-diversified portfolio spreads investments across different sectors, industries, and asset classes. For example, ETFs (Exchange-Traded Funds) track indexes, sectors, or themes, reducing reliance on the performance of a single stock. Additionally, mixing different types of investments—such as large-cap stocks, dividend-paying ETFs, and bonds—helps cushion against volatility and market downturns.

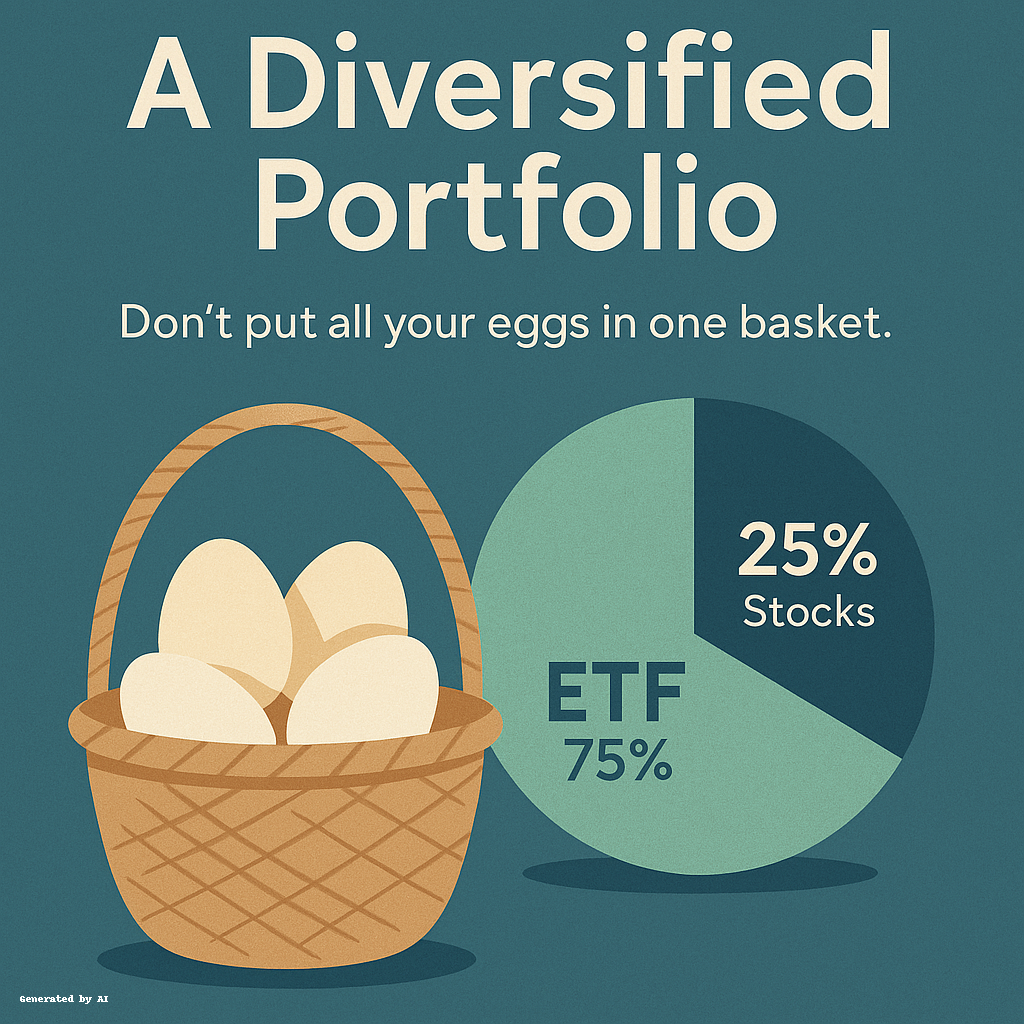

A Simple Diversified Strategy: 75% ETFs, 25% Stocks

A strong diversification strategy is to allocate 75% of your investments into ETFs and 25% into individual stocks. ETFs provide broad market exposure, lower volatility, and reduced risk, while individual stocks offer higher growth potential but come with increased uncertainty. For example, a portfolio might include:

- 75% ETFs: A mix of broad-market ETFs like Vanguard Total Stock Market ETF (VTI), high-dividend ETFs like Schwab U.S. Dividend Equity ETF (SCHD), and international ETFs.

- 25% Stocks: Selected individual companies with strong financials, growth potential, and solid dividends.

Why This Works

This allocation provides a balance between stability and growth. The ETF portion ensures consistent returns and diversification, while the stock portion allows you to take advantage of high-growth opportunities. If an individual stock underperforms, it won’t drastically impact the overall portfolio, as ETFs provide a stable foundation.

Final Thoughts

Investing is a long-term game, and reducing risk through diversification is one of the best ways to secure steady growth. A portfolio that blends ETFs and stocks protects against extreme fluctuations while allowing for upside potential. Instead of chasing high-risk opportunities, focus on building a balanced, diversified investment strategy that can weather market cycles and ensure long-term financial stability.